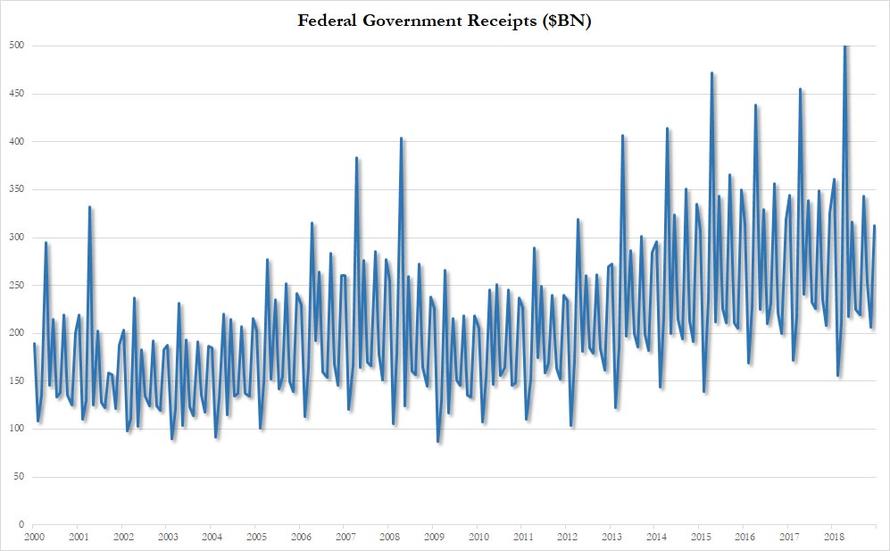

On the surface, today's monthly budget statement showed some good news: in December the US Treasury brought in total receipts of $313 billion (and $771 billion for the fiscal year to date), versus outlays of only $326 billion (and $1.09 trillion for fiscal 2019), resulting in a deficit of $14 billion, modestly worse than the $11 billion deficit expected (and better than 2017's December deficit of $23 billion). The not so good news is that for the fiscal year through Dec.31, the total US budget deficit was $319 billion, 40% greater than the $227 billion deficit for the prior year, and set to keep rising this year to $1.1 trillion.

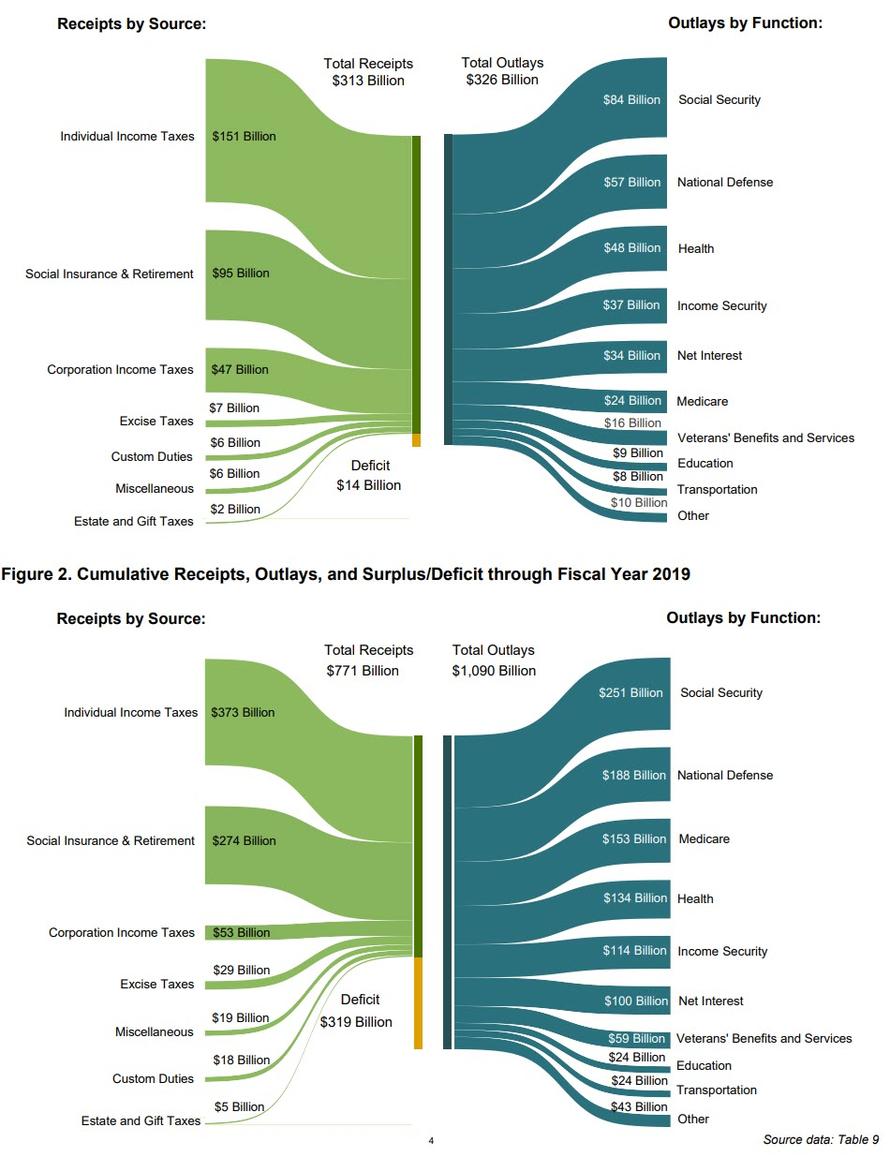

However, a more concerning data point emerges when looking at the annual change in the rolling 12 month total. It is here that we find that for the LTM period ended Dec 31, total government receipts were $3.33 trillion. This number was 0.4% lower than the $3.344 trillion reported one year ago.

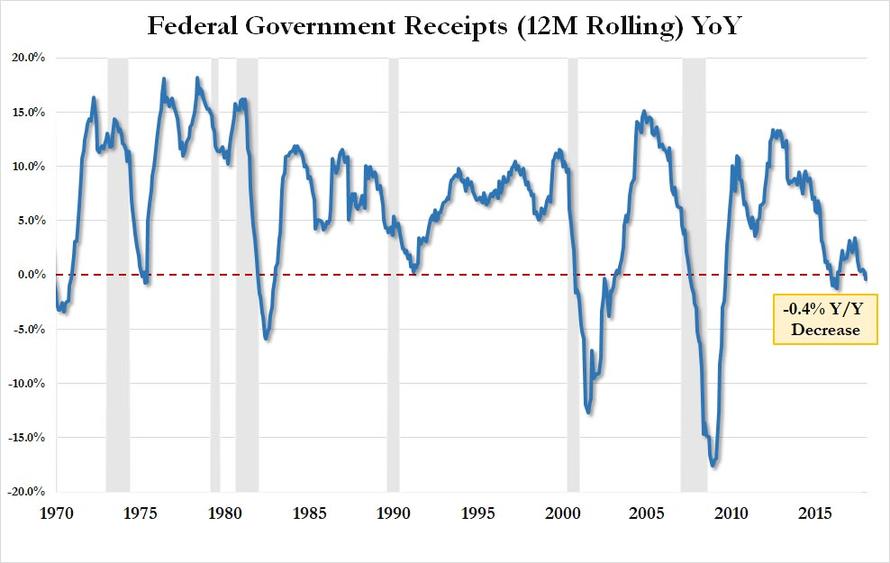

Why is this important? Because as the chart below shows, every time since at least 1970 when government receipts have turned negative on an annual basis, the US was on the cusp of, or already in, a recession. Indicatively, the last time government receipts turned negative was just after the Trump presidential victory, which however managed a dead cat bounce in the subsequent two years, before again turning negative at the end of 2018. The time prior to that that receipts turned negative: July of 2008.

The "peak receipts" of the US government are visible in the next chart, which show that after several years of relatively flat government receipts, the new trendline is increasingly lower.

And while one could argue that the collapse in receipts is due to a 19% plunge in corporate income tax in the current fiscal year compared to last, which is indeed the case, it is just as concerning that Individual Income Taxes also posted a decline, dropping 3% to $372.8BN for the current fiscal year from $386.4BN in the prior period. The offset: an increase in Social Insurance and retirement receipts, higher excise taxes, and of course, a 90% surge in customs duties to $18 billion as a result of the ongoing trade war with China (ironically, if Trump ends the trade war with China soon, this biggest increase in government receipts will promptly go away, further exacerbating the US fiscal picture).

This also begs the question what are real corporate earnings? While we hear that EPS are rising, it appears that at least for IRS purposes, corporate America is already in a corporate recession.

It is also worth noting that while receipts are now declining, government outlays are rampaging higher, with the US government spending $1.09 trillion in the current fiscal year, almost $100 billion higher than the $994 billion spent in fiscal 2018.

Finally, as we showed in the top chart, virtually every time when cumulative 12 month governmental receipts dipped into the red, the US economy suffered a recession, with just two exceptions in the past 50 years, the last being just after the Trump election. Can the president defy history twice in a row and avoid an economic contraction with receipts dipping negative for a second time in his administration?

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.